Order Books are probably the most important part of every centralized trading platform. They can provide insightful information for traders on how markets are performing and their overall liquidity. As a trader, you would greatly rely on order books to position your trades properly, especially in crypto markets where the volatility is sharper than that of traditional markets.

What’s an Order Book?

Order books are simply a list of open buy or sell orders for a specific asset on a trading platform. They help you to review the market orders of your desired asset to find the price levels that most of the market members are interested in.

Here’s the order book of ETH/USDT on the DIFX spot exchange:

Order books can also give you some information on how liquid the market of your target asset is. Order books are dynamic, meaning they are constantly updated and show the real-time direction that the market members are leaning into.

DIFX Exchange: Order Books

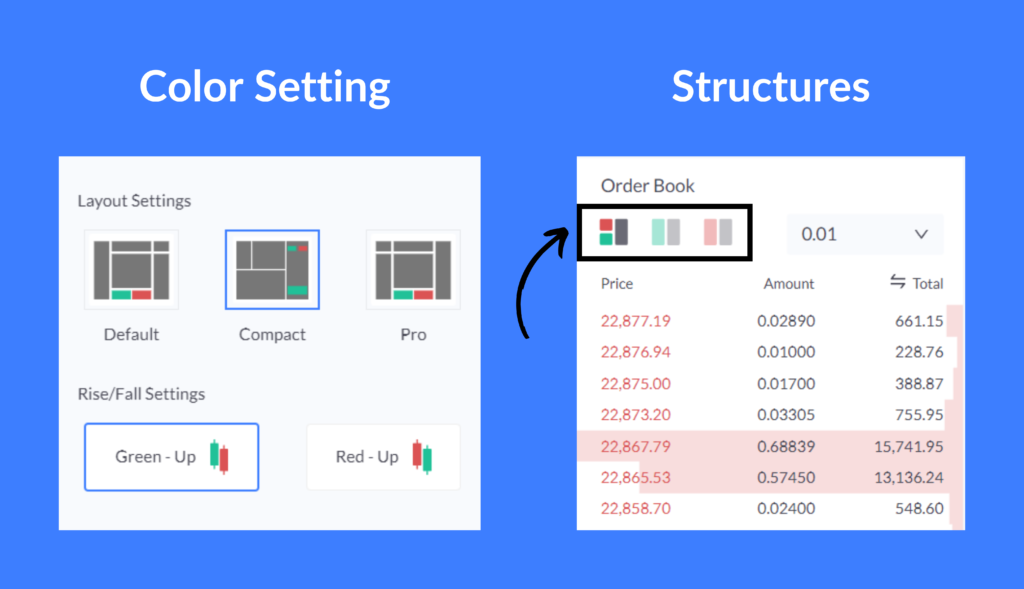

On the order books, you can see orders and their size and price. You can also change the order book’s structure and color settings. The color highlights in each order can help you to more easily realize each order’s size.

DIFX Exchange: Open Orders

On the DIFX website, the Open Order option is available on the navbar which allows you to easily access your open orders from anywhere within the website. Aside from that, you can view your open orders on the “Exchange” tab.