Just recently, South Korean authorities started a new investigation into the infamous Kimchi Premium and how some institutions are exploiting it to make huge profits; $6.5 billion to be precise.

The Financial Supervisory Service (FSS) alleged that two major South Korean banks were involved in crypto speculation using the price gap in the Korean crypto market, also known as Kimchi Premium. FSS is responsible for overseeing the financial institutions within the country.

The South Korean authorities have been on Kimchi Premium for a while now. Just last year, the rate reached 21.5%, its record high, which led to a new law coming into effect according to which all crypto exchanges were required to register within the country to be able to offer their services to Korean users.

What is Kimchi Premium?

Conceived in 2017 during the peak of the bull season, the phrase Kimchi premium —which is particular to South Korean cryptocurrency exchanges— has rapidly become a popular term in the crypto arena. Kimchi Premium refers to the price difference between Korean crypto exchanges and other cryptocurrency platforms. It defines a scenario where the price of a cryptocurrency is higher on a South Korean-based crypto exchange than on other trading platforms.

For instance, the original price for BTC could be $22,300 but on South Korean cryptocurrency centralized marketplaces, users could be buying and selling higher than $22,300. Usually, the difference could be a few percentage points or as high as 40%.

This phenomenon is known as the kimchi premium because it is similar to the price differential between South Korean and international markets for kimchi, a traditional Korean dish.

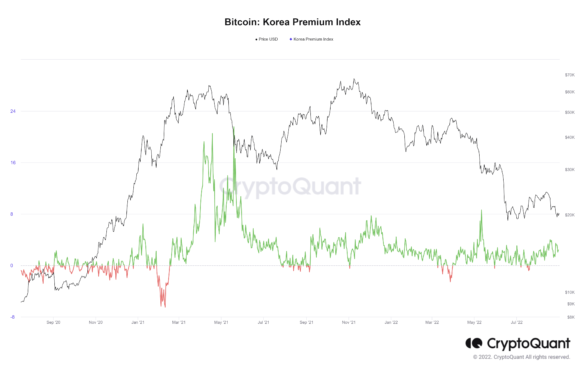

According to CryptoQuant’s Korea Premium Index, the measure sits at 2,4%, which is quite low compared to its peak in May 2021 (21.5%).

Check out the chart below to see the fluctuations of the measure throughout the years

Why Does Kimchi Premium Exist?

The stringent South Korean cryptocurrency policies which began in 2017 when the crypto market was in a bull run is what initially created the Kimchi Premium. As exchanges had to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, they noticed a reduction on user sign ups, which unfortunately affected the demand and supply for BTC & other altcoins.

Additionally, the kimchi premium occurs as a result of South Korea’s severe capital controls, which strictly regulate the limit of money that flows in and out of the nation. These limits were imposed to promote economic stability in their markets and to minimize the foreign influence on native investments.

Hence, the Korean government’s capital limitations make it impossible for a home-based crypto exchange to trade huge amounts of cryptocurrency. It also makes it more difficult for South Koreans to purchase cryptocurrencies on foreign exchanges.

These severe laws, along with the fast-expanding popularity of cryptocurrencies are what have contributed to the prices of crypto assets in South Korean cryptocurrency exchanges being way higher than in other markets.

What is Kimchi Premium Telling Us?

Retail investors are the main contributors in the Korean crypto market as the capital control rules set up by the Korean government make it harder for institutional investors to take part in the market.

This actually makes the Korean crypto market quite interesting and Kimchi Premium provides an open window into the “retailers’ sentiment and buying power” within the country. In other words, the higher Kimchi Premium indicates that more retail investors are joining the crypto market due to the surged interest or FOMO.

How Investors Are Exploiting Kimchi Premium?

Arbitrage trading allows investors and traders to benefit from price differences in various markets. Kimchi Premium offers such an opportunity to traders as they can buy Bitcoin from foreign exchanges and sell them in Korean crypto platforms at higher prices to earn profits.

However, the process is not as easy as it sounds. Capital control rules, taxes, limited international transactions allowed for a year, and other arbitrage expenses can make this process quite complicated and risky at the same time.

Looking to Buy Bitcoin?

If you are thinking of exploring how the prices of Bitcoin differs from exchange to exchange and where you can potentially buy BTC, check out https://difx.com/en to create your very own trading account to start your crypto journey!