Since its invention, Bitcoin has been promoted as a new asset class, bringing into the picture the idea of a more stable, unlimited financial system. So it’s no surprise that many economists and enthusiasts are interested in how this novel asset class is performing compared to its traditional counterparts, especially its reaction to fundamental economic indicators, like CPI.

At first, Bitcoin’s limited supply made it the digital version of gold, a safe-haven asset every investor would go to in shaky economic times. However, as time passed, Bitcoin started to distance itself from gold and follow more risky assets, like stocks.

But is Bitcoin really correlated to the traditional assets and if so, which assets and how?

What is Market Correlation?

Simply put, correlation is a statistical measure that shows how similarly different assets or markets behave or react in changing financial situations. It can take a value between -1 and +1, with +1 being a perfect positive correlation and -1 a perfect negative correlation.

We use correlation to see the relation between two different assets or markets. Here’s an example:

Let’s say Asset A and Asset B have a positive correlation of 0.7. It means that they are moving in the same direction 70% of the time. If Asset A goes up, Asset B will appreciate in value as well, and vice versa. A negative correlation, on the other hand, shows exactly the opposite; if Asset A goes up, the value of Asset B will drop.

Why Correlation Matters

Correlation shows its importance the most when it comes to risk management and diversification. As an investor, you would probably put together a group of assets that would not behave exactly the same in different market conditions. In other words, your portfolio should consist of assets with the least correlation.

In this way, they can cancel each other in extreme market conditions, meaning if one of the assets crashes, the other ones would not follow suit, bringing down your potential loss to the minimum. Or even better, the assets with negative correlation would make up for one another, saving you from any loss.

How Is Bitcoin Correlated to the Traditional Assets

Just yesterday (September 13th), the US Consumer Price Index (CPI) of August was published. The number came out 0.2% higher than the forecast (8.1%), promising another increase in the interest rate by the Federal Reserve, the central bank of the US. Raising the interest rate is a tightening monetary policy and a way for central banks to fight inflation by slowing down economic activities and people’s spending.

Shortly after the announcement, the dollar index started gaining while Bitcoin experienced a sharp drop. The largest cryptocurrency in the world fell almost 7% in the past 24h. This is not the first time that Bitcoin and the US dollar have behaved reversely, showing a negative correlation.

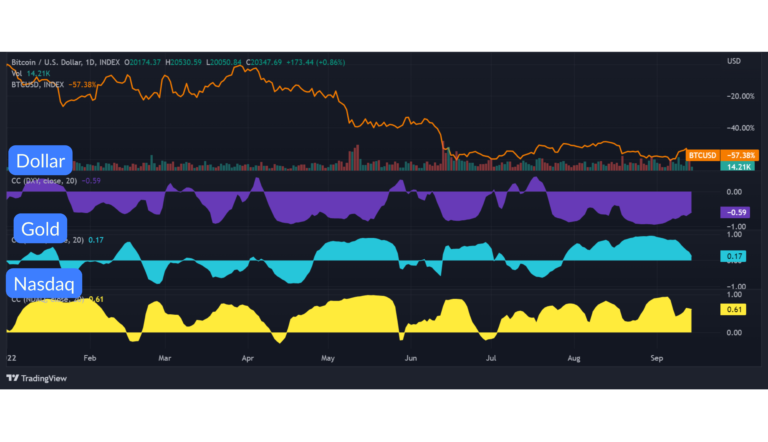

Bitcoin’s Correlation to Dollar Index, Nasdaq, and Gold

Let’s look at some charts from TradingView:

As you can see in the chart above, Bitcoin has been showing a strong negative correlation with the US dollar since the beginning of this year. The correlation between Bitcoin and Nasdaq, a tech-heavy stock index, was also strong, only the other way around. Additionally, the Bitcoin and gold correlation fluctuated in both directions during the same period.

The positive price correlation between Bitcoin and stocks has driven many investors and traders to treat both asset classes the same, watching the stock market to get insights for their crypto market analysis

The Bottom Line

With Bitcoin’s correlation to other asset classes increasing, we can’t help but wonder about the future of this currency as a safe-haven asset and how it was supposed to act as a hedge against inflation.

But before jumping to conclusions, there are few factors that we need to consider.

The recent pandemic and geo-political conflicts have left the world economy battered and it’s the first time that Bitcoin, or the young crypto market in general, is going through a potential financial crisis with a gloomy recession on the horizon.

All things considered, we can’t forget that the crypto market is quite new and still maturing and that even the well-established, traditional markets are struggling to make it through as well.

All things considered, we may witness many unexpected turns and twists as regulators around the world put all they have on the table to find their way through these uncertain times, trying to bring back the markets to the old days.