Stay ahead of the financial market with the DIFX Buzz report, which highlights the current market news and movements to help you make informed trading decisions.

Let’s take a quick look at some market data:

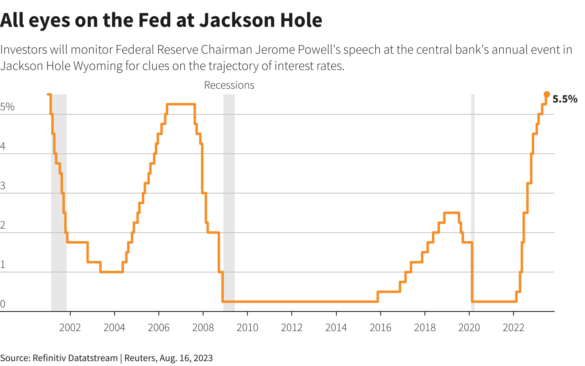

❖ Investors will be keen to gauge how dovish Fed Chair Powell’s language will be when he speaks at Jackson Hole.

❖ The current sentiment reflects that of a soft landing, with cooling inflationary pressures and robust growth in the economy.

❖ Currently, a September rate hike is not being priced in and investors are focusing on when the Fed plans to cut rates in 2024.

❖ Investors should listen to Jerome Powell’s speech on Friday for any signals as to how long rates will be kept high.

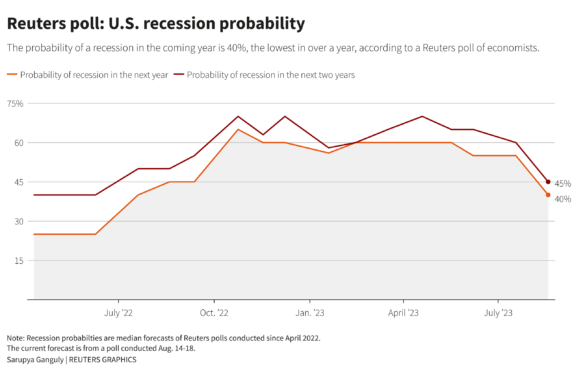

❖ Recession fears are falling after robust economic data and better-than-expected earnings reports.

❖ Inflation is cooling faster than expected with no signs of negative impact on output in the economy.

❖ Due to the solid performance of the US economy, the Fed can look to keep rates higher for longer without too much risk of a recession.

❖ As recession fears dwindle, we may see economists forecast the Fed cut rates later on in the year.

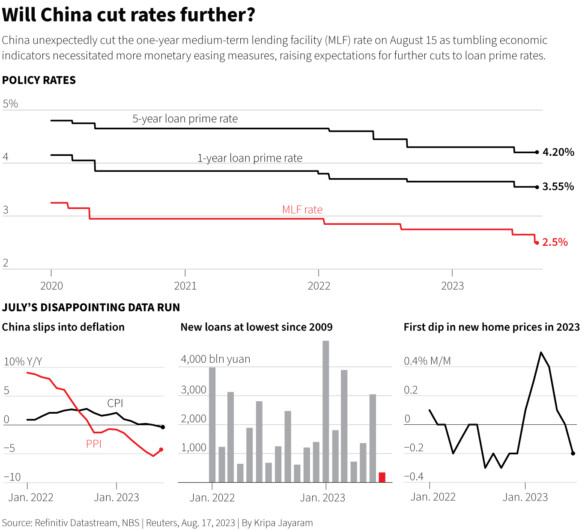

❖ As China struggles to recover post-pandemic, they unexpectedly cut the 1-year lending facility rate.

❖ Investors are concerned about whether that is enough to bolster the economy and are betting that more rate cuts will be introduced in the near term.

❖ The real estate market is adding to the weakness in the overall market with major companies in the property sector hanging by a thread.

❖ CPI and PPI are currently undergoing deflation.

❖ New loans are at the lowest in 2 years and home price growth is in negative territory.

❖ Cutting rates will increase capital for investors and boost the real estate market which will, in turn, support inflation.

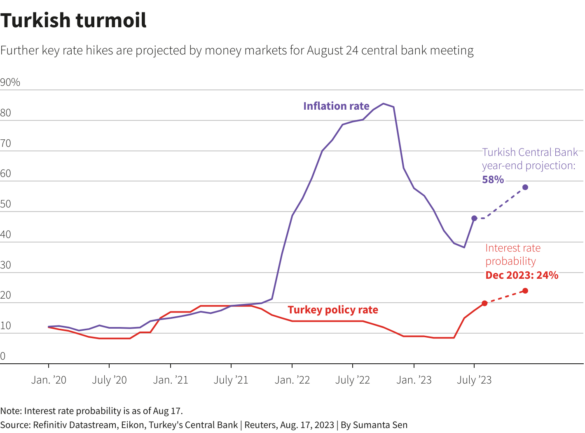

❖ The key central bank policy rate in Turkey is 17.5%.

❖ Inflation in the country is reaching extremely high as it nears almost 50%.

❖ These inflation figures are unsustainable for the Turkish economy and the governor of the Turkish central bank has vowed to increase rates at a “steady” pace.

❖ There will be a rate increase on Thursday and investors are poised to see how large the rate hike will be.

Let’s see what happened in markets this week:

❖ Nvidia which gained 6% last week, outshining its peers, is poised to have a solid week as it will report earnings on Wednesday.

❖ HSBC has raised its price target for Nvidia to $780.

❖ The chip maker has gained more value since the rise of generative AI, and the rest of the tech sector has capitalized on this hype

❖ This earnings report will be key to the equities market as it reflects the AI industry as a whole.

❖ Gold is sliding as US bond yields are nearing historic highs.

❖ Unease in China is supporting the Dollar, putting pressure on the value of Gold.

❖ Inflationary pressures are easing while the economy is performing well, and economists are projecting that this will encourage the Fed to hold rates higher for longer.

❖ Oil is consolidating as the market expresses concerns over China’s recovery.

❖ The Dollar is slightly lower at the start of the week after five weeks of bullish moves.

❖ There isn’t much movement in the Dollar due to investors awaiting signals from Jackson Hole.

❖ Fed Chair Powell is expected to provide some clues as to how the Fed plans to navigate interest rates toward the end of the year.

❖ The South African Rand is trading higher on Tuesday as the BRICS summit kicks off.

❖ Bitcoin suffered a series of liquidations last week, leading to the asset’s price falling to $26,030.

❖ Bitcoin broke out of a bullish trend it had been following since the beginning of the year.

❖ The soft-landing narrative, which indicates to the Fed that they can maintain higher rates for an extended period, exerted selling pressure on Bitcoin.

❖ Ethereum is presently trading at $1662 on Tuesday following bearish movements in the crypto market.