DIFX Buzz: Here’s a weekly market recap for you to start your Monday with the top news of the week.

Read the Data

Let’s take a quick look at some market data:

High Wages May Impact Inflation

❖ Last week, we received the jobs data and we saw non-farm payrolls come out lower than expected, at under 200k for the first time since the pandemic era.

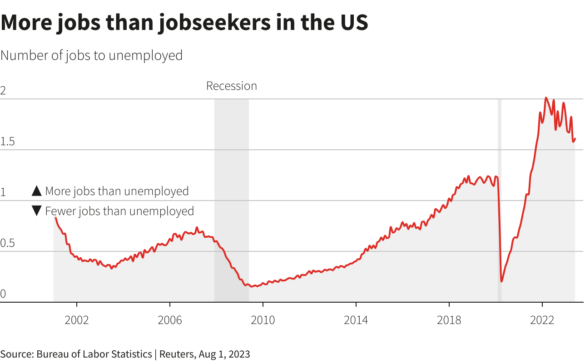

❖ However, from the chart above, we can see there are still more jobs available than there are jobseekers in the US.

❖ This is an indication that the labor market is tight, resulting in demand for workers and pushing wages higher.

❖ This was corroborated during the jobs data release as average hourly earnings came out higher than the forecast.

❖ A higher wage is good for workers but this leads to higher prices of goods and services in the economy, which ultimately increases inflation.

Communication Services and Tech Outperform the S&P 500

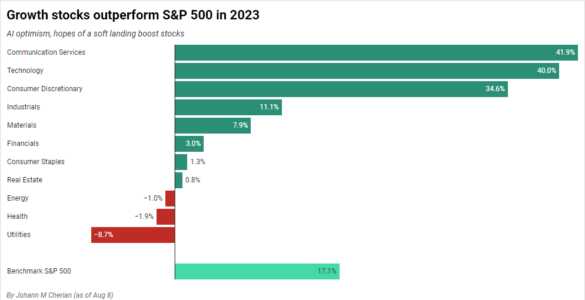

❖ 2023 will be remembered as the year the world embraced generative AI and this has been evident in the stock market as confidence in chip companies and tech companies embracing the tech have flourished.

❖ Only a handful of stocks have supported the S&P 500 throughout the year which means many investors missed out on the bull run.

❖ This means that as we see profit-talkings and dips in major indexes, there probably won’t be much downside risk as this will be an opportunity for investors who are sitting on cash to deploy it into the market.

China Is Struggling to Recover

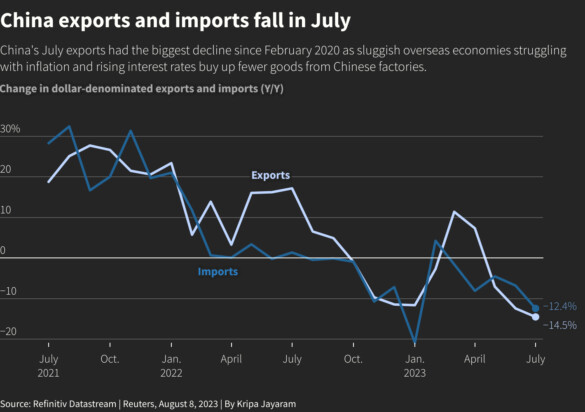

❖ Chinese imports and exports fell much faster than expected, with exports contracting to 14.5% and imports to 12.4%, both below the expected levels.

❖ Sluggish growth has been a consistent theme for the world’s second-largest economy throughout the year as it struggles to recover from the pandemic.

❖ High-interest rates in other major global economies have weighed heavily on China, with demand falling.

❖ The latest data arrives just before Chinese CPI is released this week.

❖ As analysts reassess their forecasts for the year due to this major miss, there will also be pressure mounting on officials who have mentioned stimulus to prop up the economy.

Look into Markets

Let’s see what happened in markets this week:

Forex

❖ US CPI data coming out this week will give investors an indication of how the Fed plans to navigate through to the end of 2023.

❖ A higher-than-expected reading will be bullish for the Dollar as this will indicate inflation is not on a one-way road to the downside.

❖ A lower-than-expected reading will be bearish for the Dollar and will signal to Jerome Powell that we may not need a September rate increase.

Equities

❖ Tesla’s finance chief Zachary Kirkhorn has stepped down after 13 years at the company which has come as a shock, with many tipping Kirkhorn to be Elon’s successor.

❖ Disney, which is set to announce earnings later this week, has set up a task force to explore artificial intelligence and how this can help the media conglomerate.

❖ US stock futures edged lower on Tuesday after Moodys downgraded 10 small to mid-sized banks. stating they are looking into the nation’s largest lenders.

Crypto

❖ PayPal launched a Dollar-backed stablecoin, becoming the first major FinTech to utilize digital currencies for transfers and payments.

❖ Brazil has named its digital currency DREX, with the launch planned for 2024.

❖ Worldcoin, whose sign-up process includes scanning a user’s iris in exchange for a digital identity, has registered up to 2.2 million people so far.

Commodities

❖ Crude oil imports in China fell 18.8% in July, the lowest since January, with the largest exporters cutting down on shipments.

❖ Oil fell by more than 1.5% on Tuesday after weak import and export data out of China, further accentuating the weakness within the economy.

❖ Gold is struggling to find its footing as it settles at the $1930 support after mixed jobs data.

❖ Gold which has been reactive to inflation data has been hit by rising bond yields, making the metal less attractive.