Ready to stay ahead in the fast-paced world of financial markets?

Check out this week’s DIFX Buzz – your ultimate source for a weekly market recap that kickstarts your trading week with precision and insight. In this dynamic era where every move counts, DIFX Buzz brings you the top news of the week, dissecting how these developments are shaping the financial landscape.

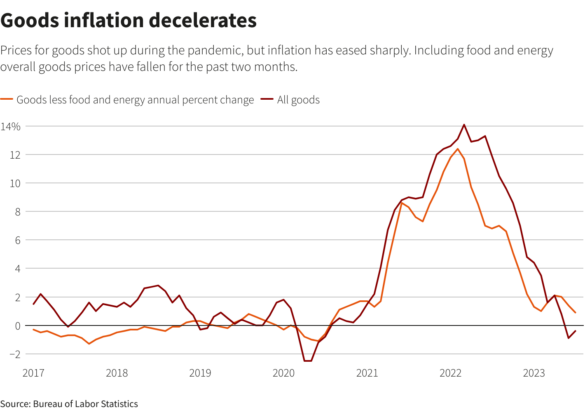

❖ Goods inflation is growing at a healthy pace and is on track to bring CPI down to the Fed targets.

❖ The Fed is confident that the worst is behind us and the next few hurdles to reach the inflation target will be smoother sailing.

❖ Goods, excluding food and energy inflation, which make up a large portion of CPI, are already below the 2% target.

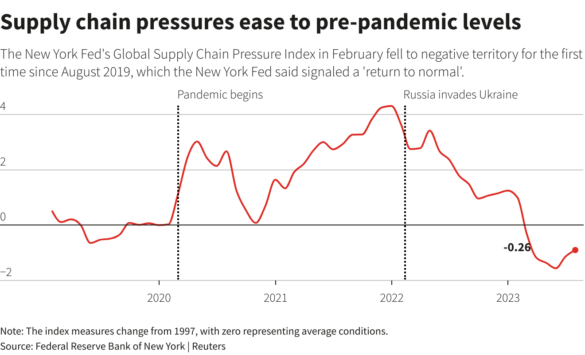

❖ Supply chain pressures are no longer affecting global trade.

❖ We are seeing pre-pandemic levels of supply chain pressures as the market stabilizes.

❖ These figures support growth in the economy which is in line with the “soft landing” narrative.

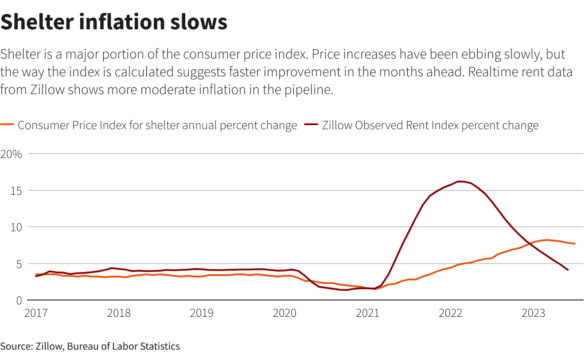

❖ CPI for Shelter is trending slightly downwards.

❖ The Zillow Rent Index is lower than 5% for the first time since 2021, which signals that rent prices in the US have grown at a much slower rate in 2023 compared to 2021-2022.

❖ As we see Shelter inflation begin to slow down, investors will have fewer concerns about the housing market.

❖ This data supports a soft landing for the US economy.

A deeper look at the markets

❖ Tesla cut prices for Model Y in China, which sent shares lower as investors are concerned about profit margins. Tesla ended the session 1.2% down on Monday.

❖ Nvidia rose 7% on Monday with its biggest single-day gain since May 25th, when it increased 24% after pummeling revenue expectations.

❖ PayPal ended the session up 2.8% after naming ex-Intuit Alex Chriss as the new chief executive officer.

Ford names ex-Apple executive Peter Stern as President of

❖ Ford Integrated Services. Stern previously oversaw Apple TV and he will bring this experience to help Ford build digital and subscription-based services.

❖ Oil was up during Tuesday’s Asian trading session after China unexpectedly cut rates to the 1-year lending rate for loans to financial institutions.

❖ Gold is falling as the Dollar rises on support from high bond yields.

❖ Uncertainty in China will result in traders becoming bullish on the safe-haven Dollar which will hurt Gold.

❖ Investors can keep an eye on developments in China for sentiment on the overall commodity market.

❖ The Dollar began the week trading higher as investors are worried about China’s struggles affecting the global economy.

❖ The Dollar, which had strengthened in recent weeks, is now being further supported by the safe haven trade.

❖ Traders should keep an eye out for any policy measures from the Chinese government to bolster their economy.

❖ If China can respond with a healthy monetary policy, then this should tame the trade.

❖ Shiba Inu’s new blockchain is set to launch on August 15th.

❖ Sand, APE and INJ will have token unlocks this week to increase the supply in those protocols.

❖ Sam Bankman-Fried goes to jail after violating bail on several occasions.

❖ PayPal sets sights on the Defi industry after stablecoin launch.