DIFX Buzz: Here’s a weekly market recap for you to start your Monday with the top news of the week.

Read the Data

Let’s take a quick look at some market data:

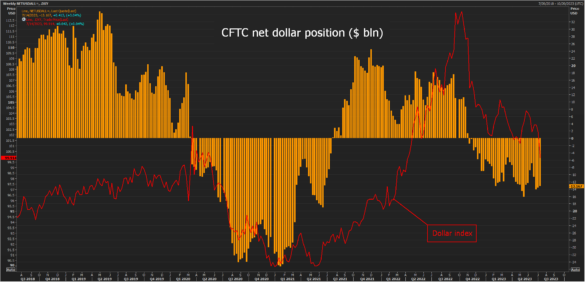

CFTC Net Dollar Position (Reuters)

❖ The CFTC data shown above is taken from the Dollar positions of speculative funds and we can see they are about $13.17 billion net short.

❖ This correlates with the falling Dollar Index which recently dipped below $100.

❖ Analysts predict that the Dollar will slide further as the hiking cycle comes to an end.

❖ The week ending June 30th showed Dollar short positions were even lower at $14 billion

❖ This could hint to hedge funds taking profits on their short positions which they may have been holding since DXY highs near $112.

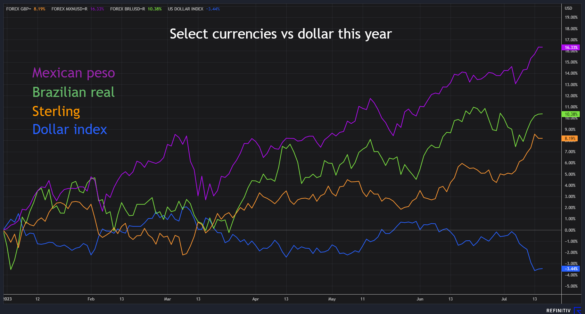

Mexican Peso, Brazilian Real, and Sterling vs Dollar (Refinitiv)

❖ The Mexican peso has had a meteoric rise against the Dollar since the start of the year and is currently sitting on a healthy 16.33% gain.

❖ The Brazilian real has also seen a substantial upside with a 10.38% gain against the greenback.

❖ The DXY is down 3.44% Year to Date and the conversation of how long this bear trade will last is of major importance.

❖ Disinflation is occurring at a solid pace and the Fed is expected to begin cutting rates early next year.

❖ This could push the Dollar even lower toward the end of the year, especially if the final July inflation indicator Core PCE data doesn’t deliver any surprises.

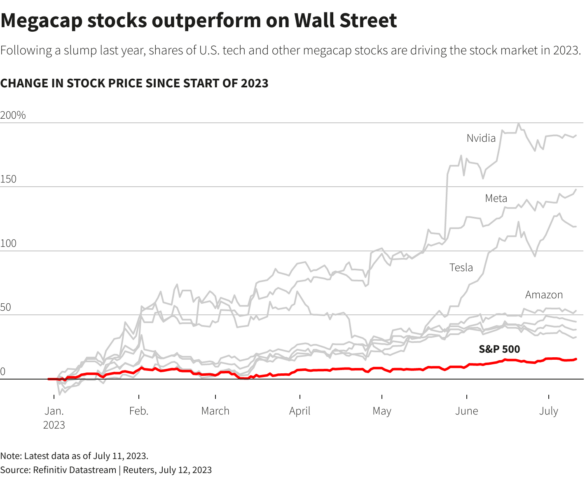

Megacaps Boosting the S&P 500

❖ Equity indexes have been boosted by a few major stocks with Nvidia, Meta, Tesla, and Amazon all in the top 7 of highest weighted stocks on the S&P 500.

❖ Nvidia has seen an almost 200% gain since the start of the year due to the AI boom.

❖ Tesla has outperformed expectations this year as well by offering a discounted price on their cars which resulted in an increase in sales.

❖ Meta has rebounded after a devastating year partly as a result of restructuring away from their metaverse focus.

Look into Markets

Let’s see what happened in markets this week:

Forex

❖ The Dollar Index dropped below $100 for the first time in 14 months as net USD short positions sat at over $13 billion for speculative funds.

❖ There is one more rate hike priced in from the Fed for this hiking cycle as Core CPI is slowing down at a faster pace than initially projected.

❖ Euro is hovering near a 17-month high as hawkish policy continues out of the Eurozone.

❖ The Turkish Lira slid almost 2% to a new low in anticipation of the Turkish central bank raising interest rates. A Reuters poll forecasts a 500 basis point increase to a policy rate of 20%.

Equities

❖ This week, we begin earnings season from large caps such as Tesla, Netflix, Bank of America, IBM, and Johnson & Johnson among others.

❖ US chip makers met with the Biden administration to discuss restrictions on China. They would prefer to ease restrictions as China accounted for almost a third of worldwide semiconductor purchases in 2022, around $180bn.

❖ Microsoft is attempting to extend its acquisition contract in order to resolve the regulatory issues over the purchase of Activision.

❖ Head of Engineering for Truth Social has announced his departure which has dealt a massive blow to Donald Trump’s social platform.

Crypto

❖ Ripple’s industry-shaking win over the SEC has projected confidence in the rest of the industry. This is a major setback for the SEC as they continue their battle against major exchanges and the largest crypto projects.

❖ Token creators have received their biggest win in the US which has been notoriously seen as delivering anti-crypto laws and regulations. This sentiment has been felt throughout the space with a wave of positivity and could result in further growth and development.

❖ Coinbase CEO, Brian Armstrong, will meet with a group of US House of Representatives and Democrats to discuss crypto legislation of digital assets on Wednesday.

❖ Elon Musk’s lawyers are going on an attack against the Dogecoin plaintiffs’ lawyer, stating that the lawyer knew the accusations were false before filing them.

Commodities

❖ An agreement for ships to cross the Black Sea safely has expired which caused Wheat and Grain futures to drop.

❖ US shale and natural gas production is set to slow down in August as output cuts occur across the largest rigs in the country. This is mainly a causal effect of low productivity and a fear of an economic recession in major economies.

❖ With Indian automobile and construction sectors booming, traders in India have been taking advantage of steel discounts out of China as other markets are not performing.